Nowadays, managing money has become very easy with the help of digital payment apps. Be it sending money to a friend, transferring to a family member, or making monthly payments, these apps make things easy beyond your imagination. Here are some of the best features of digital payment apps that make them perfect for today’s world.

1.Instant Money Transfers:

Long bank queues are now a thing of the past. With apps like CRED and BHIM UPI, you can transfer money in just a few taps. Whether it is used for splitting the restaurant bill or paying the rent money, these apps allow instant transfers without any hassle. Most apps also provide real-time notifications, so both the sender and recipient are updated about the transaction status.

2.User-Friendly Interface:

A great payment app has a smooth and intuitive design. The best platforms allow for easy navigation, making sure that even a first-time user can send money or pay bills without much complications. Saved payment details and quick-access menus help make recurring payments, like paying rent money or utilities, quicker than ever.

3.Multiple Payment Options:

Digital payment apps often have multiple options for payment like credit cards, UPI, debit cards, net banking etc. Whether it’s for grocery, ordering food, or transferring money across states, you can opt for any of these option as per your requirement. The flexibility these apps provide ensures that you’re never stuck without a way to pay.

4.Secure Transactions:

Security is a must where personal information and ATM pins and passwords are concerned. These apps often have good security where advanced encryption, multi-factor authentication, and instant alerts make sure that your transactions remain safe. Additional security can be achieved if users set unique UPI PINs.

5.Transaction History and Tracking:

It is easier to track your spending when all of your transactions are recorded in one place. Most apps have the ability to view a history of payments, making it easier to manage a budget and track where your money is going.

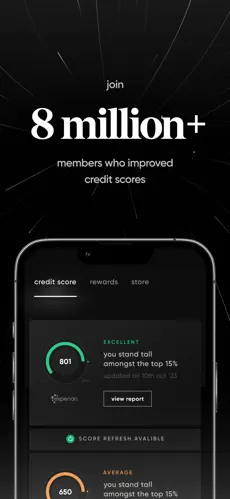

6.Cash back and Rewards:

Everyone loves getting rewarded for doing their tasks. Many apps have exciting cashback and discounts on services like mobile recharge bills or when you transfer money. So whenever you complete a payment or send money to someone you might get a portion of money as cashback. Rewards often consist of coupons and vouchers which you can redeem on online shopping apps and sites. In this way you also get discount on items from other apps. Such incentives not only save money but also make users more willing to go cashless.

Conclusion:

Digital payment apps have become an essential part of our daily lives. From simple things like mobile recharge to paying rent and your monthly bills, it simplifies things that were otherwise very time consuming. These apps make sure sending and receiving money is fast, secure, and efficient.

So the next time you need to transfer money, skip the bank and pick up your smartphone. It’s as seamless as it gets!