These days, with the world moving at a fast speed, accessing money in an emergency has never been simpler than it is today with the rise of digital lending apps. It could be for a medical emergency, an unexpected travel itinerary, or paying off debts; a good loan app can provide an instant loan in minutes. However, ease of access does bring along some issues of safety, transparency, and regulation.

To protect the borrowers, the Reserve Bank of India (RBI) has established proper guidelines for digital lending. Here’s how you can borrow loans wisely and securely through a personal loan app while being RBI norm-compliant.

Understanding the RBI Guidelines for Digital Lending:

To counter predatory lending habits, the RBI published exhaustive norms in 2022 to govern digital lending platforms. The guidelines ensure the security of the borrower and introduce transparency in the process of lending. The following are the major highlights:

- Loan Disbursal and Payment: Loan disbursals and payments have to be made directly from the borrower’s bank account to the bank/NBFC. Third-party intervention is prohibited.

- Disclosure of Loan Terms: Any loan app or loan assist business must disclose the cost of the loan, interest rate, processing fee, and repayment plan.

- Digital Loan Agreement: Borrowers should be provided with a digital copy of the signed loan contract and a Key Fact Statement (KFS) with all terms included.

- Cooling-Off Period: Borrowers must be provided with a cooling-off period in order to change their minds without incurring any penalties.

- Data Protection: Personal data collected by the app must be with the explicit consent of the borrower and should not be misused or sold.

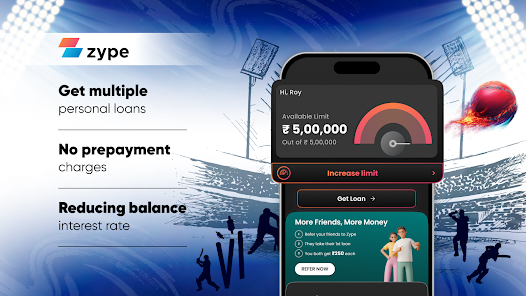

Choosing the Right Loan App:

Before downloading just any loan app, ensure it is registered and compliant with RBI regulations. Here’s how to verify:

- Check RBI’s NBFC List: Ensure the lending platform is associated with a registered Non-Banking Financial Company (NBFC).

- Transparency in Charges: A reliable personal loan app will transparently display the interest rate, tenure, processing charges, and other charges that apply before you go ahead.

- Real Reviews: Search for real user reviews on Google Play or App Store. Steer clear of apps with warning signs, such as harassment by recovery agents or concealed charges.

- Loan Assist Facilities: Certain sites also offer loan assist facilities—assisting you in determining your creditworthiness and selecting the most appropriate product according to your profile.

Instant Loan – Ease with Caution:

Obtaining an instant loan is no longer a time-consuming affair. With a few clicks on your mobile phone, money can be credited directly to your account. However, ease must not be at the expense of compliance and safety.

Always read the terms of the loan, make sure the platform is compliant with RBI’s digital lending guidelines, and borrow only up to what you can repay comfortably. Never forget that instant loans are a tool for finance and not a hack.

Final Thoughts:

In a world where loan apps are increasing daily, being aware is your best form of protection. Adhere to RBI-compliant platforms, carefully read the terms, and avail loan assist options to borrow money wisely. A rule-abiding personal loan app will not just make it easier for you to access money, but also secure your financial well-being in the future.

Borrow wisely.