In today’s fast-paced world of digitization, business finance management has become very easy, thanks to business bank apps. The flexible design of these apps gives convenience along with secure tools to help businesses smoothen out their financial operations. Whether you are a big or small entrepreneur, the choice of the right business app makes a significant difference. Here’s what to look for when selecting a business bank app:

1. Smooth Integration with Business Tools:

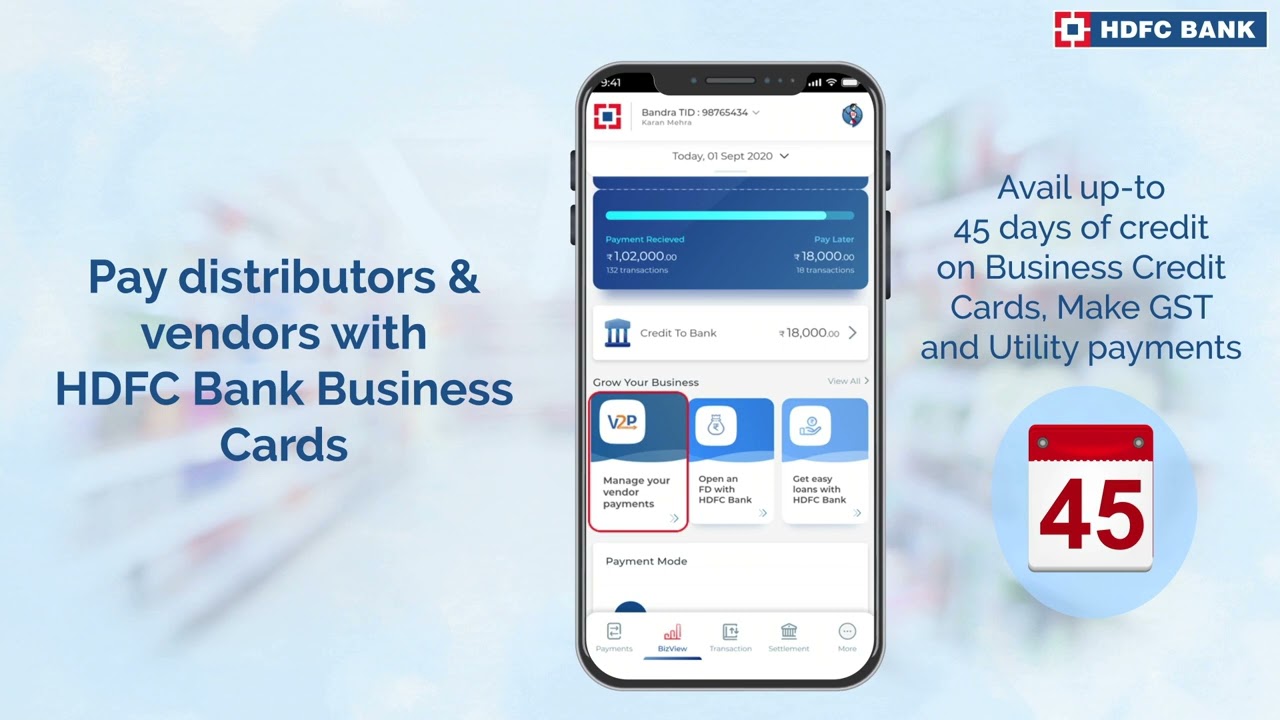

A good business bank app should integrate conveniently with other tools like invoicing platforms, accounting software, and inventory management systems. For example, apps such as HDFC Smarthub and Vyapar Invoice allow you to track invoices and link them to your bank app. This provides for a smooth way of tracking your transactions and maintaining records.

2. Efficient Money Transfer Options:

It should provide the facility of multiple modes of payments, such as UPI, NEFT, RTGS, IMPS. Through real-time transfers and auto-scheduled payments, your financial operations will be seamless and on time.

3. Loan Management Features:

The business loan management feature in the app lets you apply, track, and manage loans efficiently. You get insights on the repayment schedules and due dates, which would help maintain a strong financial position in your overall portfolio.

4. Customizable Reports and Analytics:

Detailed financial reports and analytics help you understand cash flows, expense items, and patterns of income. These are components that require planning and decision-making procedures, especially for mobile business owners, as they need quick access to the financial data on the go.

5. Expense Categorization:

Expense tracking gets easier when your bank app categorizes them into predefined or customizable categories. This feature is especially helpful for businesses that need to monitor spending and identify areas to cut costs.

6. Multi-User Access and Permissions:

If your team handles various financial tasks, a business bank app with multi-user access is essential. It should allow you to define user roles and permissions, ensuring security and accountability.

7. Robust Security Measures:

Security should always be top priority when it comes to money apps. Key features such as two-factor authentication, biometric sign-in, and end-to-end encryption all ensure your financial data is safe. It should have regular updates and fraud detection tools for maximum protection.

8. Ease of Use and Accessibility:

The user interface of the app must be easy to navigate and intuitive. Also, the app should have mobile and desktop versions so you can access all details relating to your finances irrespective of where you are.

9. Support for International Transactions:

For businesses which operate across several countries, handling multiple currencies and ability to make international transfers is a must. Look for apps that simplify cross-border payments and offer competitive exchange rates.

10. Customer Support Integration:

An app with a 24/7 customer support ensures that you have help whenever any issues arise. Whether it’s about payment failures or troubleshooting within the app, responsive support is priceless.

Conclusion:

Choosing a business bank app for your business is a critical decision for all business owners. Features like expense management, good security, and loan tracking are a must for managing finances in an efficient manner. By choosing wisely, you will streamline operations, save time, and continue growing.